If you’re a non-US self-publisher, you must have noticed that Amazon, CreateSpace, SmashWords and other US-based companies withhold 30% of your earnings for tax reasons. Last month I finally took the initiative, called the IRS and solved it once and for all. Unlike other popular but extremely long and tedious guides, this post will be as precise and as short as possible.

Goodbye 30% Withholding Tax on Royalties

US-based companies are required by law to withhold 30% of your earned royalties until you settle your tax information. To do that, some international publishers would go through months of filling forms, paying fees and visiting the American embassy to get an Individual Tax Identification Number (ITIN).

What they didn’t know is that there’s a much quicker way. So quick that you’ll be done with it in half an hour, in your pyjamas, without paying a dime.

Step 1: Get an Employer Identification Number (EIN)

International non-US authors are viewed as small business owners by the American IRS and can easily get an EIN with a short phone call. The awesome part? With the EIN you’re not subjected to the 30% withholding tax rules anymore.

Call the IRS at +12679411099 and ask for an EIN. If they ask, tell them you’re a “sole-trader” selling ebooks on Amazon. They *might* ask you for an SS-4 form. Getting this form takes time and fees and soul-sucking forms. Normally you can just say thanks, hang-up and call again, but.. it took me half an hour to reach them on the phone!

What did a seasoned Israeli guy do? told them I got this form already filled but left it in my office. The guy said “Ok” and continued, so feel free to follow my oblivious behaviour to save yourself the time, money and unnecessary headache.

Now give em your details EXACTLY as they are. Spell out loud everything until you’re certain the information is correct. If you haven’t registered a company in your country yet (you’ll have to do that eventually for tax purposes), just give them your personal name as the company’s name. They don’t ask for any proof that it actually exists.

That’s it! They’ll now give you the EIN. Write it down somewhere safely, put a copy in your Dropbox, and mail it to yourself as a backup. Go get a cup of good coffee, the hard work is done. 30% withholding tax on royalty payments will soon become history for you.

Step 2: Update Your Tax-Information

Now all you have to do is update your tax-information and you’re done. Some good news for you: you no longer need to print and fill the W-8BEN form and send it to Amazon and CreateSpace offices in the U.S. You can do it online in a minute!

Amazon KDP

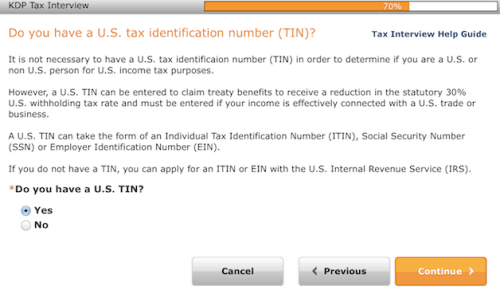

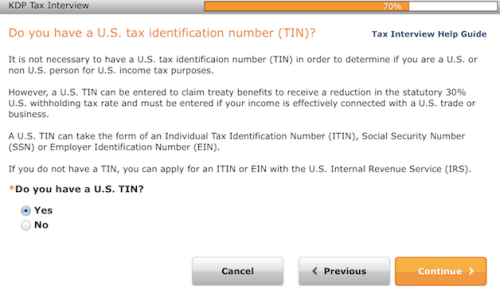

Go to your Account and scroll down to Tax Information. Click on “Complete Tax Information” to fill-in the ‘online tax interview’. When you’re asked “Do you have a U.S. TIN?” click Yes and fill in your EIN number. Submit the form when done. It took them about ten days to approve mine.

CreateSpace

Go to your Account and click on ‘Edit Account Settings‘. Go to ‘Tax & Business Information‘, click Edit and fill in your EIN in the ‘Tax Identification Number‘ field. Save and you’re done.

You should have similar procedures through the account settings on Smashwords and other publishing platforms.

Final Tip: I recommend getting this whole royalty withholding tax process done as fast as possible, preferably before publishing your first book. According to frustrated Amazonians, getting withholdings back later is a huge headache involving applying for an IRS tax-refund. I didn’t even bother.

Bonus: Royalty Withholding Tax Rates By Country

How much royalties withholding tax deduction are you entitled to? I’ve reduced it from 30% to 10% because my country (Israel) has a 10% tax treaty with the U.S. Most Europeans are entitled to a big round 0. Here’s the full list, updated to August 2014:

Australia: 5%, Austria: 0%, Bangladesh: 10%, Barbados: 5%, Belgium: 0%, Bulgaria: 5%, Canada: 0%, China: 10%, Cyprus: 0%, Czech Republic: 0%, Denmark: 0%, Egypt: 15%, Estonia: 10%, Finland: 0%, France: 0%, Germany: 0%, Greece: 0%, Hungary: 0%, Iceland: 0%, India: 15%, Indonesia: 10%, Ireland: 0%, Israel: 10%, Italy: 0%, Jamaica: 10%, Japan: 0%, Kazakhstan: 10%, South Korea: 10%, Latvia: 10%, Lithuania: 10%, Luxemburg: 0%, Malta: 10%, Mexico: 10%, Morocco: 10%, Netherlands: 0%, New Zealand: 5%, Norway: 0%, Pakistan: 0%, Philippines: 15%, Poland: 10%, Portugal: 10%, Romania: 10%, Russia: 0%, Slovakia: 0%, Slovenia: 5%, South Africa: 0%, Spain: 5%, Sri Lanka: 10%, Sweden: 0%, Switzerland: 0%, Thailand: 5%, Trinidad & Tobago: 0%, Tunisia: 15%, Turkey: 10%, Ukraine: 10%, United Kingdom: 0%, Venezuela: 10%

The IRS lists Commonwealth of Independent States as 0% so I guess all other CIS members Armenia, Azerbaijan, Belarus, Kyrgyzstan, Moldova, Tajikistan and Uzbekistan are all 0%. All other countries don’t have any tax treaty with the U.S and will retain the 30% withholding tax rates.

Enjoy your writing journey, I wish you the best of success.

Thanks for this post. I followed your suggestions and it worked exactly as you described and I had my EIN in 30 minutes… no hassles!

Nicely done, Peter.

Thank you so much for this, I’ve just managed to get mine sorted. The first time I called he wanted me to fax over my SS4 form, so I filled it all in and found a way to fax online, rang back and the lady I then spoke to didn’t even mention it.

Way to go, Elodie.

does this 30% tax also apply to non US amazon affiliate??, about two months ago, i and other affiliates from indonesia were forced to fill the tax information..

i don’t really make a lot of money from amazon to be honest, so i’m really scare if they cut my earning..

thanks for your help..

You’ve gotta do it, mate. You’ll pay 10% instead of 30% taxes as and Indonesian.

Actually. if you live in the UK, you just need to provide your NIN, no need to obtain any other number. It is very well explained here https://catherineryanhoward.com/taxinterview/

Thanks for the info.

I live in Poland and for me it was enough to provide a Polish tax ID (NIP) to get the 10% rate.

Hey mihu.

I’m also from Poland. Could you tell me more about how it was for you? Namely: where did you publish your book? Did you have to fill out the Form SS-4, or did you put in your NIP on some form on a publishing page? Did you register your own company?

I will be very grateful for your help.

Am a Nigerian. I had a royalty payment of over $400 dollars but after the 30% my payment is $280. Please its absurd! Can I fill another country in the tax infomation, so they send my cheque there with 0%. So later I cant get it. Its so sad after much effort only little is paid. I already called IRS and I got the EIN but it made no difference since am a nigerian.

I’m a Nigerian too but just published my first book two weeks ago. I just found this out and it’s really too bad. But I guess we just have to live with it or create our own African Amazon.

Exactly

Hi Regev!

What a GREAT article! I have been pounding the online pavement looking for an answer for my friend in Russia and here it is. I have NO idea how you managed to come up with the solution without a GREAT article like this one to guide you!

Massive thanks!

Norm

Cheers Norm, happy it was helpful. Thanks for the good words brother.

Thanks so much! I called an had my EIN in less than 17 minutes after reading this post. Great information!

Awesome, Marsha, glad to hear.

hello!

I asked for an EIN.

However on Amazon they say ” if you are an individual that is not claiming that your income is effectively connected with a US trade or business, you may not enter an EIN as your US TIN will take the form of a SSN or ITIN”

How can I deal with that?

Should I say I’m not an individual but a corporation?

Thank you.

You mentioned mentioning name of the company later. I want to ask how much later? Because when the cheque comes, it’ll come under company’s name. So I have to register it just after completing tax interview, right?.

How do Deaf authors do this? I am in Finland but still have to pay this American tax, but I cannot use a telephone.

Get someone to do it for you.

is this working for non-U.S. person ?

Yes. I am not from the U.S.

Does it applies also to international author working for US-based book publishers other than Amazon? My country doesn’t have any tax treaty with the USA. Thanks!

Hi Regev,

Thanks a lot for the tip. Could you tell me what details they ask when you call IRS? So I can prepare the info before calling. Thanks.

Hello!

Great post! One quick question, since I am from Malaysia, which does not have tax treaty with US, i still have to pay 30% withholding tax even though i managed to get the EIN. Is this correct?

Thank you

Hey, I am Malaysian but currently I published my ebook in UK. However, next year I will be back to Malaysia. How supposedly I will be getting paid for my royalty? Can we use any bank in Malaysia as a medium to payment? Thanks

Brilliant article. Well done, the information was helpful and accurate. I had to call 3 times. The first time I got hung up on after 35 minutes. The second time I tried for several hours but was told it was too busy. The third time, after 40 minutes, I got through and was given an EIN number straight away. Very easy once I got through. Skype call quality wasn’t brilliant so had to repeat spelling a few hundred times :)

Thanks again, you really did help me a great deal with this process and saved me that 30%.

Fox

Hello,

Thank you very much for the very helpful post

I’m from Morocco and I’m entering the Amazon FBA Business

Do you know from where I can get the withholding tax rate for physical goods. I’m a little lost…too much information on the net but nothing very helpful

Hope to hear from you soon

Have a nice day

Jawad

I noticed your listing of the Royalty Withholding Tax rates by country. Could you provide a link to this listing? Or might there be an updated one for at least 2015?

Really an amazing Article – Most useful and purposeful.

This is a great article! This is exactly what I am searching for so long to avoid the dreadful 30% Withholding Tax. It could means survival or dead.

Thank you so much!

Will this work if my country doesn’t have a tax treaty with the US ?

When I call Call the “IRS” what will be their requirements?

Cheers! I’m from New Zealand, i made the call, did what you said and had my EIN within twenty minutes! thank you so much for the insights!

Awesome! My pleasure.

Hi! I did as instructed and got the EIN number and submitted to Amazon KDP but after 2 weeks they say my tax information does not match the IRS records. Is it because I submitted too soon? Somewhere it says the IRS database takes 60 days to update. I am from Sri Lanka

Hi Dr Raveen,

I’m interested to hear how you managed as I’m also from Sri lanka.

Anyone else here from Sri lanka, have any experience completing Amazon Associate Tax form and TIN No?

I’m thinking of registering and getting a tax number from Inland Revenue Department of Sri lanka.

The rate for India is 15% and I filled up the form as an individual and the withholding rate is 15% as applicable to my country. Even if you hadn’t entered the EIN, you would have paid only 10%

This is for any INDIANS it might help: I’m in India. I just entered my PAN number and it worked as foreign TIN number. In India the TIN is given to businesses not individuals, and if you know ANYTHING about India, they’re right old b4stards who will make your life hell. They require Rs 20,000 to give you a TIN number, after a LOT of paperwork and a personal interview (where you must appear in person). My form got accepted right away after I entered my PAN No. Since there is no equivalent of an ITIN in India, the PAN number comes closest. Now my withholding rate is 15% which is as per the info on this website, according to the treaty they withhold 15% from India.

i followed through your advise,amazon royalty withholding reduced from 30% to 15% but when i published my book i was asked to choose between 70% and 30% royalties i chose 30% royalty option

i assumed that i would shrink to 15% since i provided them with tax information but amazon is still withholding 30% any advise ?

Hi Rupesh,

Amazon provides two options based on the price of your book. It is 70% and 35%. You can choose anyone and go ahead.

Woowww, impressive! Thanks for sharing such valuable and helpful information :) :)

Hi! Interesting article, I have read many articles sharing the same story so must be true, now, I’m kinda self publisher too but not from ebooks, but videogames, what people call indie devs, we are mostly under the same situation, instead of amazon we publish on Steam or other online stores, but, do they offer EIN too for this kind of bussiness? just asking in case you know something about it ;). Thanks a lot pal!

I have but little doubt in my mind that the same process will work perfectly for you game-designers too.

Hello, I called to the phone number for asking my EIN number. And I finally got this! :) but they told me that I have to wait 2 weeks until receive by mail to my home address a doc to confirm that this number is activated. I thought it is inmediatly. Did anyone have the same situation? I’m from Perú.

Sergio

Thank you for this! saved me a LOT of money

Hello,

Wonderful article, saved me from a lot of hassle.

I got my EIN today, in how many days do they send the number via snail mail?

Also I was told by the support officer on phone to hold updating my Amazon account with the EIN number received till I receive the same via mail or else Amazon will get back to you saying invalid tax number provided.

Please comment on your experiences.

Hi, brilliant article, saved me a lot of hassle too! The agent I spoke to said that I can use the EIN right away with KDP. She also said that if I want a copy of the document I need to have a fax number and they will fax it right away. I was unable to give them my full postal address as their system limits entry to x amount of characters and there’s no way the snail mail will ever find me given the limited details I was able to vie, so I will find a friend with a fax and get it sent through that way. Very happy though and thanks to Regev for posting this! :)

Hi I was about to start the process but maybe you could give me a hand XD, was filling the fss4 just in case, as I read that they ask the same questions answered in the document, in step 9a, what should I check in? “Type of entity

(check only one box)”, I read the instructions on the irs site but in this step they didn’t help much :P, so well, thanks again!

OK! I just called them without that information, and they of course asked it, I was honest and told them I was not sure what to fill in 9a and they guided me though the most possible option, they even provided an spanish translator for the process, I was quite surprised how easy the process was, so thanks Elya for all this information, I finally got my EIN!

Best Wishes for you!

So, how’s your game selling on Steam? Its link? :-)

Hi Regev!

Thanks for this info. Much appreciated. I like when people write like this, meaning everything being concise and in one place.

There’s something I’m not sure about. You wrote that I’ll have to eventually register a company in my country for tax purposes to avoid 30% tax. Does that mean I’ll have to pay fees concerning running a company and not just publish as an individual? If so, when should I register a company to avoid wasting money on its upkeep? As soon as possible, or when I’m ready with everything to publish?

And one last question: can I apply for EIN at a later date to get lower taxes if I don’t do it in the beginning?

I’m from Poland and this will be my time publishing a book. I’m gathering info about how to best go about it and want to do what I can right. I apologize if asking about everything like that is a problem.

By doing this We need to pay taxes in USA?

YES!!! Getting an EIN is really bad advice, gives you an obligation to file US Federal income tax returns every year!

So, it looks like the EIN is NO LONGER functional for an individual. I had previously (successfully) registered as an Australian for tax purposes and had my withholding rate reduced to 5%. Logging back into Amazon recently however, I saw that it had changed back to 30% (I received no notification, no nothing – it just flipped back to 30%). I went through the rigmarole of trying to re-register my details, and it seems the EIN is no longer useable. This is the error message I got.

“Based on your prior inputs, an ITIN or SSN would be expected, but you have provided an EIN. Generally, EINs are issued to businesses and organizations. Your prior input for Type of Beneficial Owner is an Individual and not a business or organization. You can either provide the ITIN or SSN of the individual who is the beneficial owner, or if the beneficial owner of the income is a business or organization, please update your previous inputs.”

This is the current state of play. Does anyone have any relevant updates in light of this sad money-grubbing fact? :(

This is really bad advice, DO NOT get an EIN. Doing so will obligate you to file US federal income tax returns!

Hey! your post catched my attention , I’m a non use residesnt/citizen and I requested an EIN last year around october, since then I have not used that number yet, do I had to do somthing with legal stuff or papers? I mean what happen if I don’t submit any tax stuff since I have not started any bussiness till this date? I’m a bit scare tbh I would really appreciate an answer since I don’t know much about all this things. Greetings!

As far as I know I’m a not resident alien, acording to this I don’t have to file a tax return since I didn’t have any income, again all this is so confusing to me, I would like a clarification, I think different things applies for residents and aliens https://www.irs.gov/individuals/international-taxpayers/taxation-of-nonresident-aliens

Thanks very much I didnt fancy paying two lots of tax!!

I got the EIN number within 10 minutes, however, after filling in all the details, the final W8-ben form still show 30% withholding, why is that?

Does this work also with Envato Marketplace?

Hi !

Did you finally try this for Envato Marketplace ?

Yes, it does. Thanks to this article. Just follow the mentioned instructions.

OK !

And what kind of obligation you have with the Ein Number ? any kind of anual papers, statements, or other things to bring to the IRS?

Thanks for the great article. I am from India and the withholding rate is 15%. Can I further reduce it to 0% if I get a EIN?

What does that mean?”if no tin is provided, any reduction of the 30% statutory withholding tax rate applicable to your u.s. source payments will not apply.”

Hi everyone! Many many thanks to the author for this post! I am from Trinidad and Tobago and looking into publishing some KDP books…. will this method still work now, in 2021?

Thanks in advance for all your help!

Regards,

Natasha